- LLC INDEPENDENT CONTRACTOR EXPENSES TAX DEDUCTIONS HOW TO

- LLC INDEPENDENT CONTRACTOR EXPENSES TAX DEDUCTIONS SOFTWARE

One thing the IRS has stated-if your 1099 income is greater than $150,000, they believe there’s a higher propensity of you combining personal expenses with business expenses. And again, it really depends on how creative each person wants to be. I’ve seen expenses as low as 10% of income all the way up to 50-60% of income, with an average in the 15-20% range. Is there any sort of average ratio of 1099 income to deductions? Use the sleep test-if you think you’ll have trouble sleeping over a deduction, skip it. An example: some people are confident arguing that their gym memberships are deductible because that's where they do their networking, while other people are introverts and don’t talk to anybody at the gym, meaning they wouldn’t deduct their gym memberships.

LLC INDEPENDENT CONTRACTOR EXPENSES TAX DEDUCTIONS SOFTWARE

For example, is the software you’re listing as an expense only used for business, or do you use it for personal use, too? Same goes for your cell phone, computer, and so on.Īs for how aggressive to be, we encourage everybody to stay within their own comfort zone.

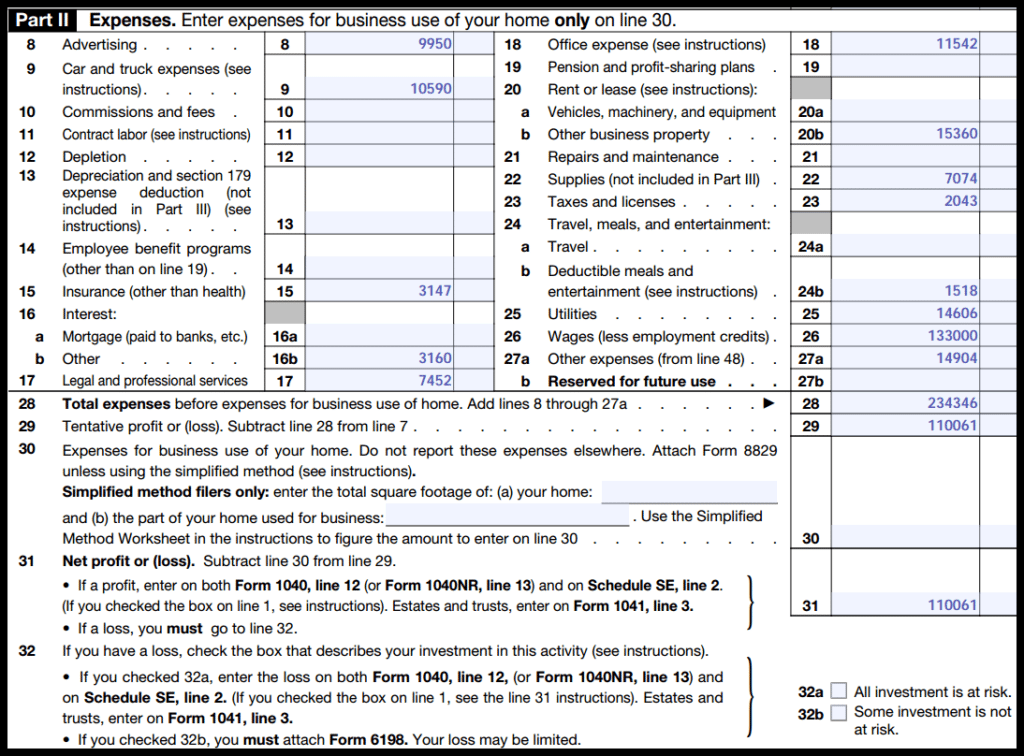

You essentially need to be able to prove that the expenses you’re running against your 1099 income are necessary to your business. They will likely look at your expenses and ask you to substantiate them with receipts and credit card statements. If you're running a 1099 business and you’re showing losses for five years straight, you're likely going to get audited because the IRS will be suspicious.

the percentage of your rent or mortgage expenses), but also to utilities and internet.Īre there factors that increase or decrease the risk of getting audited? How do you know how aggressive to be with business expenses? That would be your business use percent-and it extends not only to the space itself (i.e.

Take that 200 square feet and divide that by your entire home square footage. Let’s say 200 square feet in your house is dedicated to your office space. How do you calculate a home office deduction?

LLC INDEPENDENT CONTRACTOR EXPENSES TAX DEDUCTIONS HOW TO

Home office space (more on how to calculate this in the next question).What are some of the most common deductions for these types of contractors? There aren't a lot of hard, physical costs associated with digital marketing consulting. Disclaimer: This is neither financial nor legal advice please speak with your CPA. We’ve transcribed and organized all of the information they shared with us, and we’ve broken it down into three key sections: an overview, info about tax deductions (which you're currently reading), and details about the CARES Act and Paycheck Protection Program. As a reminder, the 2020 tax filing deadline was recently extended to May 17, 2021. to join us for an hour-long webinar to share their expertise and answer your questions ahead of the upcoming tax filing season. Taxes as a 1099 contractor can be complex, which is why Right Side Up invited Greg and Amita from Harrison Accounting Group, Inc.

0 kommentar(er)

0 kommentar(er)